In recent years, the real estate market in the Kingdom of Saudi Arabia has witnessed significant transformations as a result of the influence of local and global economic factors. Saudi Arabia’s real estate market is vibrant and developed, heavily influenced by economic factors that shape its trends. In this article, we will analyze some of the key economic factors affecting the real estate market in Saudi Arabia.

In 2023, the Saudi real estate market maintained its level of annual deals with a total value exceeding 277 billion riyals ($74 billion), compared to 223.5 billion riyals in 2022, according to Asharq Al-Awsat newspaper. Market statistics recorded a continuation of the size of the deal area at about one billion square meters for both 2023 and 2022, while the number of real estate deals witnessed a decline of 20 percent from 325,000 to 260,000. We noticed a significant decrease in the outer neighborhoods and on the outskirts of cities, especially in the city of Riyadh. Growth continues until now in 2024, as the rate of growth in the Saudi real estate market increases until it reaches $100 billion by 2030.

The impact of economic growth on real estate demand

The impact of economic growth on real estate demand in Saudi Arabia reflects developments in the national economy and their direct effects on the real estate market. Despite global economic challenges, Saudi Arabia has succeeded in adopting diverse development strategies and enhancing non-oil sources of income. Which contributed to achieving stable economic growth in the long term. This diversification of income sources and improvement of economic infrastructure reflects Saudi Arabia’s strategy towards enhancing stability and sustainability in the real estate market.

As a result of this economic development, Saudi Arabia has witnessed an increase in demand for real estate, whether for housing or investment. Rates of internal and external migration towards major cities have increased, which has increased pressure on the real estate market in those areas. Meeting this growing demand has led to an increase in prices and rents, especially in major urban areas such as Riyadh, Jeddah and Dammam. In addition, high real estate demand rates reflect economic optimism and confidence in the future. This makes real estate in the Kingdom an attractive option for local and foreign investors alike.

If you also want to know more about the impact of global events on the Saudi real estate market

Government policies and public investments

Government policies and public investments play a vital role in directing the real estate market in Saudi Arabia. The government adopts rational policies aimed at strengthening the real estate sector and attracting more investments. For example, the Kingdom’s urban development programs and Vision 2030 represent major initiatives aimed at developing infrastructure and promoting economic sustainability.

Through huge investments in urban and development projects, the government enhances confidence in the real estate market and opens the door to new investment opportunities. These projects include developing cities, building housing, developing industrial areas, and improving transportation and road infrastructure. These public investments contribute to stimulating economic activity and promoting comprehensive development in the Kingdom. This reflects the government’s commitment to providing a suitable and sustainable investment environment for the real estate sector.

The government has played a vital role in guiding the real estate market through its various policies and initiatives, such as exempting real estate transactions from the 15% value-added tax and easing property tax, which has led to enhanced residential real estate market activity. Besides, economic reforms have significantly transformed the Kingdom’s real estate market, opening the door to new investment opportunities and increasing stability in the market.

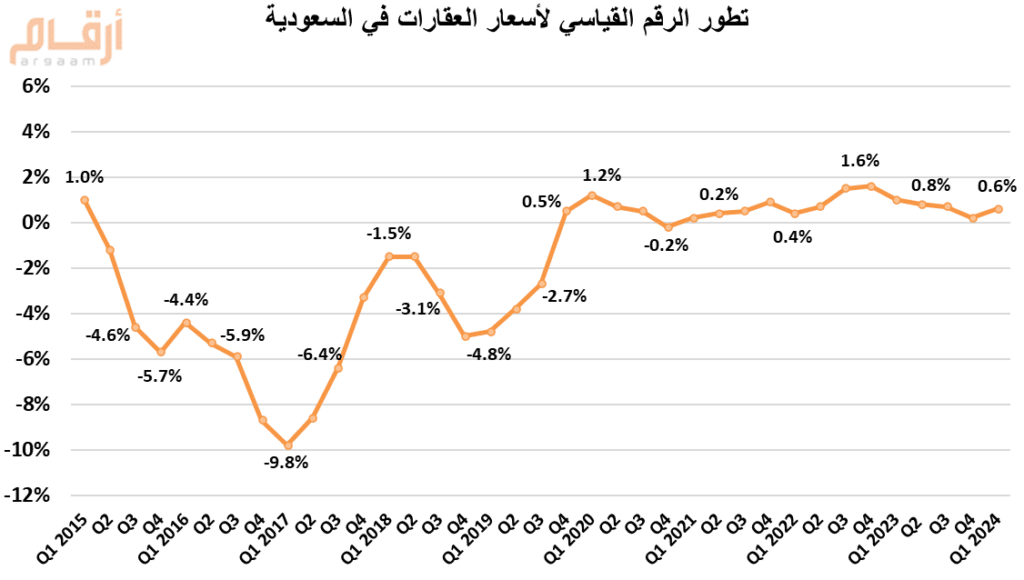

Real estate price index

Real estate prices in the Kingdom of Saudi Arabia recorded an increase during the first quarter of 2024, increasing by 0.6% compared to the same period of the previous year, according to data issued by the General Authority for Statistics. According to these data, the real estate price index reached 83.0 points during the first quarter of 2024 based on the base year of 2014, compared to 82.5 points during the same period in 2023.

The real estate price index in Saudi Arabia, set by the General Authority for Statistics, uses the year 2014 as a base year (100 points) to calculate changes in prices over the years. This index is regularly updated to reflect economic and market changes in the country, which helps in understanding and analyzing trends in the real estate market and estimating real estate values.

A report issued by “Ocean X” The report showed that residential real estate occupies 67.2% of the value of this market, while the contribution of commercial real estate is 32.8%.

The expectation of the residential real estate market is going to witness an increase in the number of properties, to reach 6.9 million properties in 2024. The report expects this trend to continue with an increase in the number of residential properties to reach 7.3 million properties by the end of 2028.

Population growth

Population growth is a vital factor in shaping the real estate market in Saudi Arabia. The country is witnessing rapid population growth as a result of demographic factors such as the increase in population, changing family structure, and geographical distribution of the population. This population growth is generating an increasing demand for real estate, especially in large cities such as Riyadh, Jeddah, and Dammam. Where most population growth is concentrated.

As demand for housing increases, pressure on available supply rises, typically leading to higher prices and rents in those areas. This reflects a major challenge facing the real estate market, as the government and the private sector need to think strategically about how to meet the growing demand for housing. Providing diverse and convenient options for citizens and residents. These challenges require effective coordination between public policies and investment strategies to ensure that population needs are met and the real estate market is sustainable.

Oil prices are economic factors

Oil prices play a crucial role in the economy of Saudi Arabia. The oil exports are one of the country’s primary income sources. It contributes significantly to financing the general budget and supporting development programs and government investments in many sectors, including real estate.

When oil prices fall, the Saudi economy typically suffers negative effects. The decline in oil revenues reduces the ability to finance government programs and development projects. Which leads to a slowdown in economic activity and increased pressure on the government’s financial resources.

The impact of lower oil prices could have negative repercussions on the real estate sector as well. The economic recession resulting from low oil prices could reduce confidence in the real estate market and reduce investments in real estate development and infrastructure projects. Therefore, demand for real estate may decline as the purchasing power of consumers and investors decreases. Which ultimately leads to pressure on prices and rents in the real estate market.

Standard & Poor’s expects economic growth in the Gulf region to reach a rate ranging between 2% to 3% during the current year, with continued sustainable growth that depends largely on the oil sector. It also expects a strong increase in non-oil economic activity in the UAE and Saudi Arabia by a rate ranging between 4% to 5%. This rise is due to large public investments and the influx of foreign direct investments. Standard & Poor’s added that more than 85% of real estate companies in the Gulf countries are stable but face challenges from geopolitical tensions and global and regional economic fluctuations. A slowdown in the global economy may weaken demand from foreign investors and reduce demand for oil from regional buyers.

Challenges facing the real estate market

These challenges are major factors affecting the real estate market in Saudi Arabia. First, lack of financing hinders the ability to purchase and invest in real estate. It is difficult for individuals to obtain real estate financing at appropriate interest rates. This reduces the number of purchasing transactions and reduces the volume of demand for real estate, which negatively affects the real estate market in general.

On the other hand, bureaucracy and complex bureaucratic procedures are also an obstacle for investors and developers. The process of obtaining permits and licenses may be slow and complicated, leading to delays in the implementation of real estate projects and increased costs.

The scarcity of available land for real estate development poses a significant challenge, particularly in major cities with high demand for real estate. This shortage can lead to an increase in the prices of available land and thus an increase in the costs of real estate projects, making them unaffordable for developers and investors.

You can find out what’s new in our properties

Saudi real estate market expectations

The expectations of the size of the real estate market in Saudi Arabia is going to be rise to US$94.19 billion by 2028, contributing to an increase in the country’s GDP by 8.8% by 2030. The percentage of workers in the real estate sector is also going to increase by 2.57% annually by the same year, According to the future vision of the Kingdom.

The size of the commercial real estate market in Saudi Arabia is expected to reach US$31.35 billion by 2028. Also, an increase in investment opportunities and ease of travel encouraged by international airports are expectedly to be positively impact the expansion of the commercial sector, especially in Riyadh, the main business hub of the Western Region.

It is expected that the demand for administrative offices will increase in the main cities of the Kingdom with the start of the implementation of economic reforms within the National Transformation Plan and the Kingdom’s Vision 2030, which will support growth and prosperity in the real estate market in Saudi Arabia. It is expected that growth and prosperity in the real estate market in Saudi Arabia will continue with the continued implementation of the Kingdom’s Vision 2030. Future expectations indicate an increase in real estate projects and a diversification of the real estate market, making the real estate market in the Kingdom of Saudi Arabia the focus of attention of investors in the short and long term.

Conclusion

In conclusion, it is clear from the analysis of the real estate market in the Kingdom of Saudi Arabia that there are several factors that directly affect it, and these include economic, demographic, and governmental factors. When interest rates, inflation rates, and economic growth are reviewed, it becomes possible to determine market trends and estimate its stability.

In addition, the population and its geographical distribution play a prominent role in determining the level of demand for real estate. While government laws, legislation, and support programs play a vital role in directing investments and enhancing confidence in the market. It is expected that, with the continued focus on developing infrastructure projects, the real estate market in Saudi Arabia will remain strong and stable for the foreseeable future.