The city of Riyadh is one of the most vibrant and growing cities in the Kingdom of Saudi Arabia. As it is witnessing rapid urban development and increasing demand for real estate. With this growth, investors find themselves facing two main options: buying apartments or investing in land. Both options carry their own advantages and challenges, making it necessary to make a careful comparison to understand which one provides the best investment returns. In this article, we will review the prices of apartments and investment lands in Riyadh. We will also analyze the potential returns for each option, to help you make the optimal investment decision.

Apartment prices in Riyadh

Apartment prices in Riyadh have witnessed a noticeable increase in recent years, due to population growth and increased demand for housing. Prices vary based on location, area, construction quality, and available facilities. For example, apartment prices in luxury areas such as the Diplomatic District and Olaya District can range between 700,000 and 2,000,000 Saudi Riyals. While prices in developing areas such as Al-Yasmeen and Al-Narjis neighborhoods are lower, ranging between 400,000 and 1,000,000 Saudi riyals.

Prices of investment lands in Riyadh

Investment lands in Riyadh are an attractive option for many investors, especially with the rapid urban development. Land prices vary based on location, proximity to services, and available infrastructure. In commercial areas such as the King Abdullah Financial District and the Nakheel District, land prices range between 2,500 and 5,000 riyals per square meter. As for emerging residential areas such as Al-Arid and Laban neighborhoods, prices range between 1,000 and 2,500 riyals per square meter.

Investment returns

Apartments

Investment returns for apartments are attractive due to their stability and strong demand in real estate markets, especially in vital locations. Apartments are one of the best real estate products for investment due to the possibility of achieving stable rental returns. These returns can range between 4% and 8% annually, making it an ideal choice for long-term investment. Investing in apartments carries many financial and practical benefits, the most prominent of which are:

Providing a stable income: Renting apartments is one of the most reliable sources for generating a stable income, as this is achieved by collecting monthly rents from tenants. Diversification of investment portfolios: Investing in apartments is an important part of diversifying investment portfolios, as the investor can allocate part of the capital to invest in residential real estate to enhance the stability and balance of his investment portfolio. Also, the value of the property increases over time: The value of apartments often witnesses a gradual increase over time, and this reflects the continuous demand for residential properties and the growing population.

Ease of management: Investing in apartments can be less complicated compared to other properties such as villas or land, since managing a single apartment is less expensive and effortless than an entire property. In addition, there is a continuing demand for apartments in real estate markets due to the continued need for suitable housing for residents, and this increases the chances of resuming apartments and continuing to generate income.

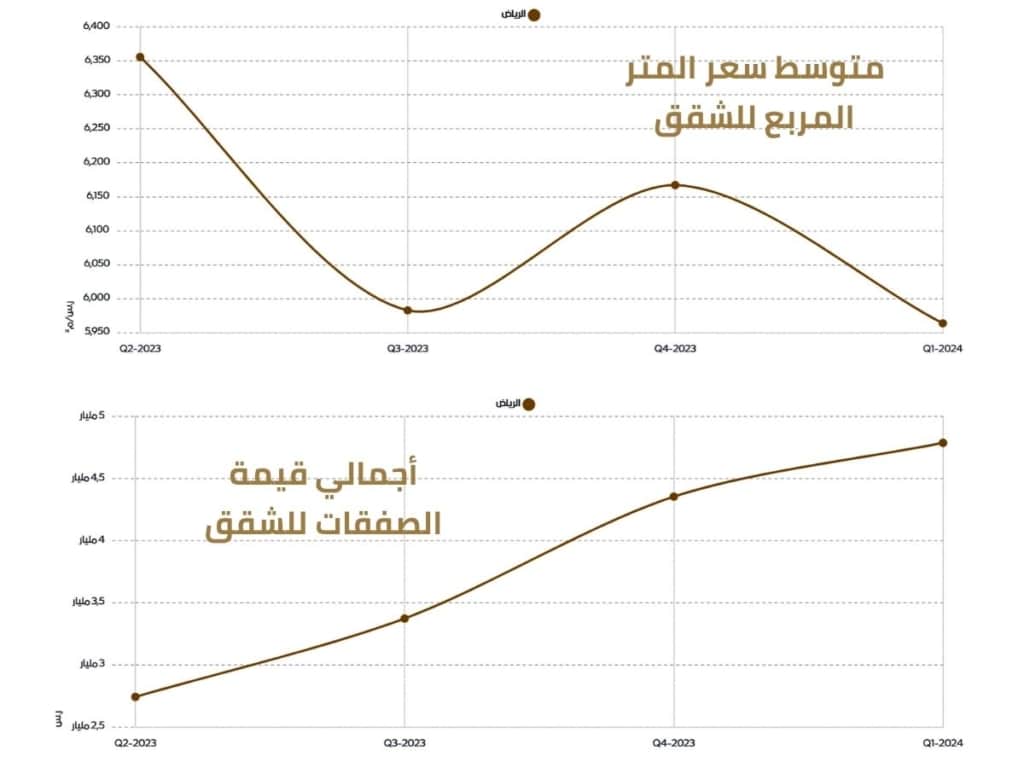

This figure shows the average price per square meter for apartment prices and the total value of transactions as reported by the General Real Estate Authority

You may want to read about apartment and villa rental trends and price expectations in Riyadh

Lands

Land is a long-term investment option, as its returns depend on the increase in the value of the land over time. Returns from land sales can be high, especially in areas experiencing significant urban growth. However, it may take a long period of time for the lands to achieve the required profitability. Land investment has many benefits and advantages, including:

Increasing the value of assets: Land is a fixed asset whose value increases over time, especially in areas witnessing urban development and economic growth. Also real estate development opportunities: Landowners can exploit them to develop various real estate projects such as residential, commercial or industrial, which enhances the opportunities for profitability and achieving financial returns. Also diversifying investment portfolios: Land investment is an important part of diversifying investment portfolios. It contributes to distributing investments among different assets to achieve balance and reduce financial risks.

Land investment allows greater flexibility in management compared to some other assets such as companies or stocks, as land does not require intensive daily management and can be kept for long periods without the need for costly maintenance. In addition, landowners can benefit from partnership opportunities with real estate developers or government agencies to develop real estate projects and achieve financial returns.

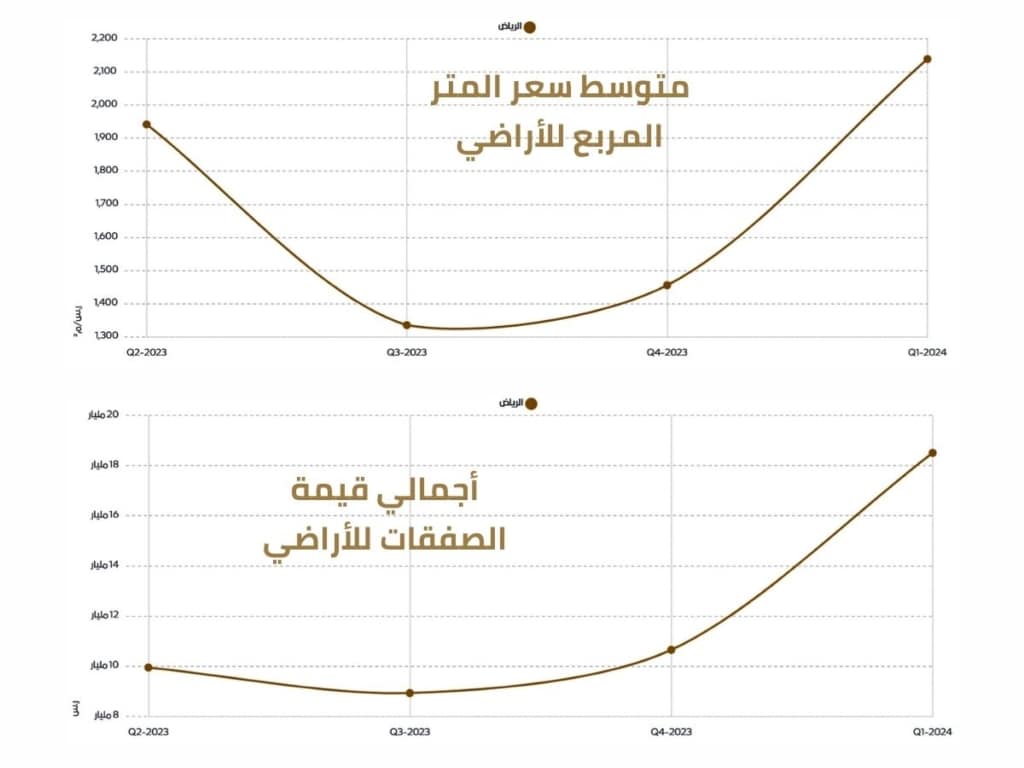

This figure shows the average price per square meter for land prices and the total value of transactions as reported by the General Real Estate Authority

Which is better for investment?

The choice between investing in apartments or land depends on the investor’s goals and the desired investment duration. If you are looking for a stable and sustainable income, apartments may be the right choice for you. If you prefer a long-term investment and want to achieve large profits from the increase in the value of assets, investment lands may be the best option.

Conclusion

Ultimately, both apartments and land are promising investment options in Riyadh, and each offers unique advantages. The final decision depends on your personal preferences and investment goals. Regardless of the option you choose, investing in the real estate market in Riyadh is a smart move given the continuous growth and development the city is witnessing.

View the comprehensive guide to the process of purchasing villas and apartments