The real estate market is a vital component and an essential source of any economy, as its performance is affected by multiple factors, including bank interest rates. Low values are a catalyst for increased demand in the property market, as they make borrowing more affordable. This makes it easier for potential homebuyers to obtain mortgages at affordable rates.

In Saudi Arabia, the impact of interest rates on the real estate sector is significant, as they have the ability to shape property prices, influence mortgage affordability, and investment decisions. When it is low, the demand for purchasing real estate rises due to the availability of loans at concessional rates, which pushes the market towards more activity and prosperity.

However, rising interest rates can pose a major challenge to the real estate market. An increase in it leads to higher borrowing costs. Which reduces the purchasing power of potential buyers and affects investment decisions in the real estate sector. Therefore, the market must adapt to these conditions by developing strategies that allow investors and buyers to deal with changes in interest rates more effectively.

The impact of interest rates on real estate investment in the Kingdom

Real estate investment in the Kingdom is greatly affected by bank interest rates, as they play a pivotal role in determining the cost of borrowing for real estate investors. When interest rates are low, the cost of borrowing becomes lower, which makes investing in real estate more attractive to investors. This leads to increased demand for real estate and higher investment activity in this sector. Investors find in periods of low interest rates an opportunity to obtain loans at lower costs, which facilitates the process of financing real estate development and increases the size of their investments.

In contrast, higher interest rates increase the cost of borrowing, which may reduce the attractiveness of real estate investments. When borrowing costs rise, potential returns on investment become lower, causing investors to reevaluate their investment plans. High interest rates can reduce the profitability of real estate investments. Investors face challenges in financing new projects or expanding existing projects due to the additional costs associated with high interest rates.

Accordingly, real estate investors in Saudi Arabia monitor interest rate fluctuations very carefully to make informed investment decisions. A good understanding of the impact of interest rates on the total cost of projects helps investors determine the appropriate times to enter into new investments or modify their current strategies to ensure achieving the desired returns on their real estate investments.

You can also read about the analysis of economic factors and their impact on the real estate market in Saudi Arabia

The Saudi real estate market and the recent rise in interest rates

The Saudi real estate market has witnessed noticeable impacts as a result of the recent rise in bank interest rates. This rise led to a kind of slowdown in the mortgage market, which negatively affected the real estate sector and the construction industry. Increased borrowing costs have made it difficult for buyers to secure mortgage financing. This reduced the demand for real estate and increased the challenges facing investors and real estate developers.

However, the negative consequences of increasing interest rates were not universal. An increase in contract awards for mega projects and other major developments partially offset these effects. These huge projects, which include major national initiatives within the Kingdom’s Vision 2030,. It provided important support to the construction and real estate sector, which helped alleviate some of the pressures resulting from high financing costs.

Reducing liquidity

The Saudi Central Bank decided to raise the repurchase agreement rate by 25 basis points to 5.25 percent. He raised the reverse repurchase agreement rate by 25 basis points to 4.75 percent, stressing that this decision is in line with the Central Bank’s goals of maintaining monetary stability and supporting financial stability.

Dr. Abdullah Baeshen, Chairman of the Board of Directors of Team One Financial Consulting, pointed out that raising the interest rate will reduce liquidity in the economy and reduce inflation rates, but at the same time. It will increase the cost of living and the cost of acquiring valuable assets or long-term assets such as real estate. He explained that real estate prices are expected to rise as a result of the scarcity of demand, despite the availability of supply.

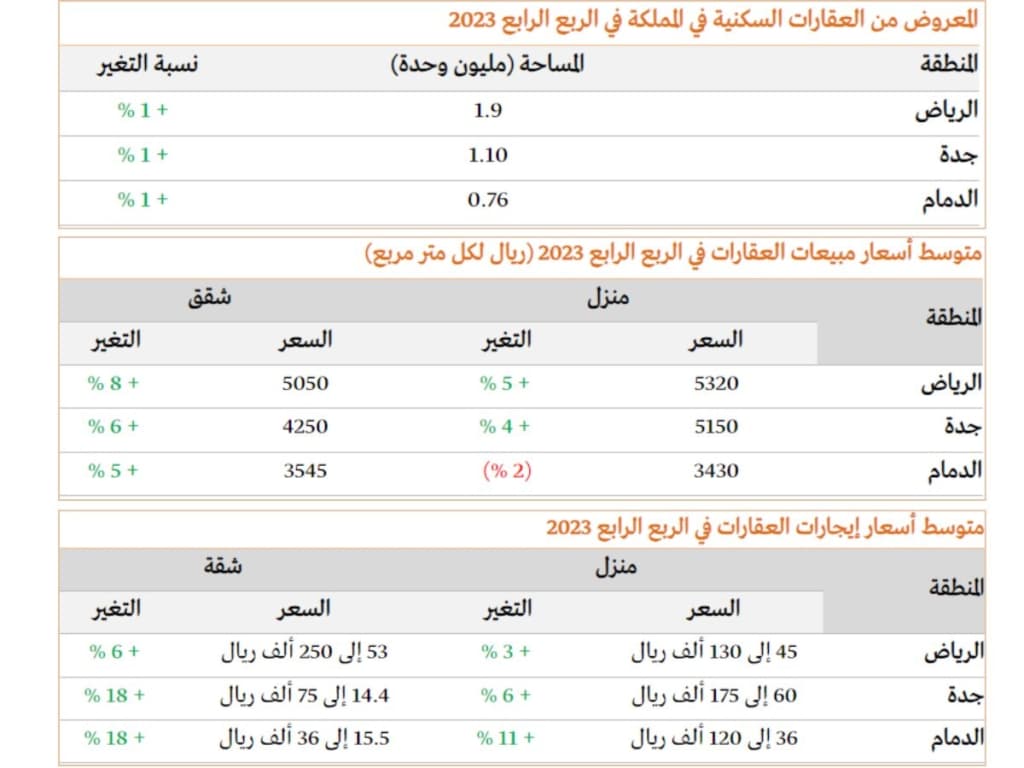

Due to the increase in the cost of borrowing or providing the financial value of assets, which contributes to an increase in asset prices, including real estate. According to a recent report by Deloitte, the supply of residential real estate in Riyadh in the fourth quarter of 2023 increased by 1% to 3.8 million units, and by 1% also in Jeddah and Dammam to 1.1 million units and 670 thousand residential units, as mentioned in “Argaam“.

You can learn more about our new property

Conclusion

Rising interest rates typically affect durable goods, including real estate and housing construction. This was confirmed by real estate expert Khaled Al-Ajlan. Consumers anticipate price reductions and look for better offers when interest rates rise, which leads to a buildup of demand. In parallel, real estate development companies begin to fear increased supply and move towards reducing supply quantities. As inflation returns to normal rates and interest rates gradually decline, the real estate market is witnessing a rapid increase in demand with a shortage in supply. This significantly increases real estate prices. In this context, buying in installments when prices are stable and selling in installments to adjust the buying and selling averages and achieve good returns in the average time, is the ideal choice for the real estate investor.